Page | 24

Revenue - FY 2015/16

o

I turn now to the Revenue for FY2015/16.

o

At 24.4% of GDP projected for FY 2015/16, tax revenues as a percent of

GDP would be the highest it has been for four (4) fiscal years.

Tax Revenue % of GDP

FY2012/13

FY2013/14

FY2014/15

FY2015/16

23.9%

23.6%

24%

24.4%

o

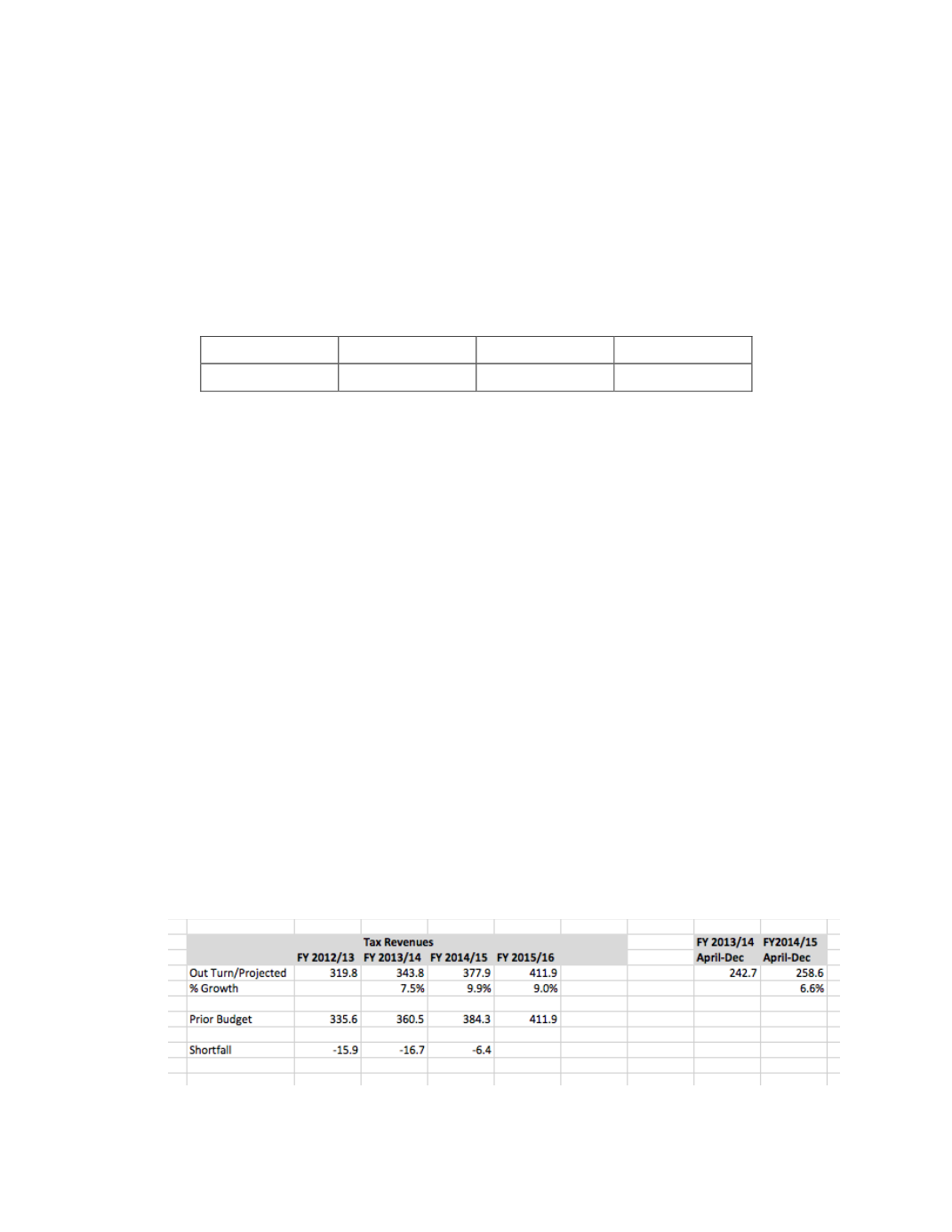

The government has projected tax revenues of $411.9 billion for FY

2015/16. (Table below). This represents 9% growth relative to the $377.9

billion tax receipts the government is projecting for FY 2014/15. Inflation is

expected to be 6.3% and so there is real growth of 2.7% anticipated in tax

revenues.

o

The 9% growth is

not credible

as tax revenues have been running below

budget for three fiscal years and the government has had to reduce its

budgeted figures midway through the process to remain credible.

Additionally, the current growth rate for taxes for April-Dec 2014 is

6.6%

relative to the same period in 2013. This growth rate is approximately a

third less than what the government is projecting for the full fiscal year

2015/16. (Table below.) It is not evident what will accelerate growth in the

2015/16 fiscal year to get to a full fiscal year growth of 9.0% in tax

revenues.